The Australian labour market is characterised by significant levels of diversity and mobility, therefore as an employer you need to be mindful not only of the opportunities to employ a diverse workforce, but also the good management required to manage the legal risks associated.

Compliance must remain a top priority.

With our ageing population and many Australians going abroad to live or work, Australia relies more on immigration more than almost any other major developed country in the world. There are many clear advantages and studies show that migrants contribute substantially to the economy and to innovation in business.

And as Australia re-opens its borders to welcome back visa holders – including working holiday makers, international students and work visa holders – employers need to be mindful about their obligations when hiring international workers.

In this blog we will discuss:

- Mobility in the Australian labour market

- 3 Golden Rules when employing overseas workers

- Case law and practical studies

- Getting it sorted: Tools and takeaways

Future trends will create many opportunities

If we look at the big trends, our economy is characterised by the globalisation of talent, advancing technology, an ageing population and changing demographics. These factors are creating lots of opportunities but also driving shortages in certain occupations and industries.

These factors are no small challenge to Australian business. Businesses need to work harder to attract, retain, develop and engage talent, especially millennials. The good news is that the best and brightest talent are prepared to follow opportunities around the world, creating a more open and diverse supply of talent.

Compliance: Golden rules when employing workers on visas

We know the workplace of the future is going to be more diverse than ever with multiple generations and people from various cultural and ethnic backgrounds working together.

We also know that there will be a demand for entirely different skills, experience and work practices, and businesses will need to innovate in response resulting in the emergence of new products and industries. This is what we call the business case for diversity and it also comes with a set of “rules”.

Rule #1: Know your employees’ work rights

Under the Employer Sanctions Act, as an employer it’s your duty to understand your employees’ visa status. The onus is on the employer to also check work rights before and during employment. This also includes paid and unpaid employment (internships and volunteer placements).

Despite the fact that this law has been in place since 2013, employers are surprisingly unaware of their obligations to know their employee’s work rights before the person starts work and throughout their employment. Employing someone without the appropriate visa and working rights is a criminal offence.

The Act was amended in June 2016 to introduce new non-fault civil penalty provisions which apply to both employers and referrers of illegal workers. Non-fault means there will be no requirement to prove that the employer knew the worker did not have permission to work. It will be enough that a non-citizen is found to be working without a visa or in breach of visa conditions.

Examples of possible offences

- Allowing a student to work more than 40 hours per fortnight.

- Employing a working holiday maker for more than 6 months.

- Requiring a visa holder to work in a lower position than the one they were sponsored for.

- Requiring an intern or trainee to do work which is not part of the approved training program.

It’s easy to check the work rights of an employee with an online tool called Visa Entitlement Verification Online (VEVO) tool, which provides up to date information about an employee’s visa status and the work conditions attached to their visa.

The Migration Agency also provides a visa verification service designed for employers with a sizeable visa holder population to manage work rights verifications. We provide easy-to-understand information on what each visa is and how each visa condition works.

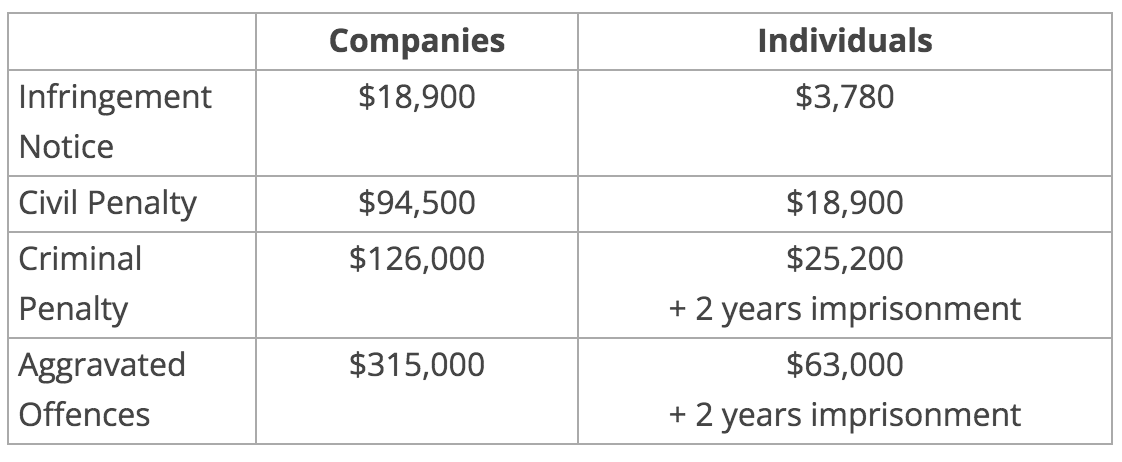

Consequences of a compliance breach

Failure to monitor employee work rights can have serious consequences. Significant penalties apply, and directors and executive officers can be personally liable if the business engages workers illegally. Criminal and civil offences exist for executive officers (directors, secretaries, chief executive officers and chief financial officers).

However, they are fault-based and apply when:

- There is work related contravention by the body corporate;

- The officer knew, was reckless or was negligent that the contravention would occur;

- The officer was in a position to influence the conduct; and

- The officer failed to take all reasonable steps to prevent the contravention.

The overall aim of the Act is to maximise voluntary compliance by using a graduated series of employer educational measures and sanctions. Such that, where non-compliant behaviour is identified by the DoHA, administrative “Illegal Worker Warning Notices” would usually be given in the first instance, unless in cases of exploitation, an aggravated offence or multiple findings of non-compliance.

How employers can stay compliant

To balance out the civil penalty provisions and criminal offences there are statutory defences available to protect employers and referrers from liability if they have tried to do the right thing. Statutory defences are available where “reasonable steps at reasonable times” are taken by an employer to confirm work rights.

Some examples of reasonable steps include:

- Conducting work checks through “VEVO” before and during employment.

- Creating a contractual obligation for a third party to verify work permissions.

- Creating a contractual obligation for another party to supply persons with the required work permissions (for example, a contract management/on-hire firm to verify workers rights before outsourcing or placing on site).

- Inspecting an Australian or New Zealand passport or citizenship certificate.

- Inspecting a visa approval notification.

For example, an employer would not be civilly liable if they were to hire someone on the basis of a fraudulent or misleading visa approval notification or visa label which indicated full work rights (such as an Australian permanent residence visa approval notification). However, there is the potential for an employer to be civilly liable under the Act if they continue to rely on old visa records when re-engaging or re-employing workers during periods of contract renewals, particularly as visas are subject to being cancelled or replaced or expiry.

Rule #2: Australian employment law applies to migrant workers

All employees are entitled to the same work conditions as Australian and permanent resident workers. It is really important to be aware that migrant workers are entitled to exactly the same pay rates and work conditions as local employees. It does not matter what the employer thinks the job may be worth, what the employee is happy to accept, what other businesses are paying or what the job may pay in the employee’s country of origin.

It is also important that internship and vocational placement programs not be used to exploit international workers. These programs can be used for short-term training only but not as a source of labour – if the person is performing productive work then they are entitled to be paid wages.

The Fair Work Ombudsman has a special division which is dedicated to workplace issues relating to migrants. The team is well-versed in workplace laws and visa and immigration rules to assist employees who experience workplace issues concerning their visa.

Case Study: Underpayment of a worker for not being an “Aussie”

Two international students working at a DFO food outlet were underpaid $23,000 and $27,000 respectively because they were “not an Aussie”. The employer threatened to cancel the student’s visa if she complained to Fair Work. She was paid a flat rate of $12 an hour, when the Modern Award base rate was $23.15 an hour.

The employer was investigated by the Fair Work Ombudsman, and ordered to :

- Pay $50,000 restitution to 2 employees

- Pay $5000 donation to the Western Community Legal Centre

- Annual audit for 3 years and mandatory training

Lesson for employers: All employees must receive minimum entitlements under the Modern Awards and workplace laws regardless of visa status or country of origin.

Case Study: Misuse of unpaid internships

An Australia media agency, AIMG Pty Ltd, offered “internships” to international students from China involving 180 hours of unpaid work over four months. Thereafter, it paid the students an hourly rate of $6.56 an hour, rather than their lawful entitlements under the relevant award.

The company was fined $272,850 and the company director fined $8,160. At the hearing, the Court noted: “[T]he Court will not countenance attempts to disguise employment relationships as unpaid internships and thus deny employees their required minimum entitlements”.

Lesson for employers: Unpaid internships must not be used to circumvent ordinary wage entitlements of workers.

Case Study: Accessorial liability for conduct in Coles Supermarkets supply chain

Coles sub-contracted its shopping trolley collection to a third-party contractor. Upon investigation by Fair Work, it was found that 10 trolley collectors were underpaid $220,000 over 18 months with some contractors paid as little as $5 an hour.

Following the investigation, Coles gave an enforceable undertaking to:

- Declare its “ethical and moral responsibility” for the conduct of its subcontractors.

- Back-pay $220,000 to the 10 trolley collectors.

- Establish a $500,000 fund to back-pay other underpaid workers in the supply chain.

- Mandatory training, audit and compliance program.

- Directors of the trolley operator company were fined $94,050 each.

Rule #3: Don’t give immigration advice or charge for a migration outcome

Business managers and HR teams should not give immigration advice or assistance to employees.

Examples of possible offences include:

- Using your knowledge to assist a colleague with a temporary work visa.

- Helping a director with a business skills visa.

Providing information about how to obtain a permanent residence visa excludes advice given by HR to the business about sponsorship or nomination, or advice given by a person who is a registered migration agent.

Meanwhile, in 2015, it became a criminal offence to offer or receive payment or other “benefit” for visa sponsorship. Civil and criminal liability for both the business and the visa holder. “Benefit” is broadly defined to include:

- A monetary payment or other thing of value

- A discount

- A gift or property

- An advantage

- A service

Case Study: “The Quick and Easy Way to Get PR”

Clinica advertised “quick and easy PR” to foreign workers, under a scheme where the worker was charged $30,000 to $40,000 to study a cleaning course then be provided sponsored employment and eventually permanent residence. More than 97 workers paid Clinica over $800,000 to participate in the scheme.

The Australian Competition and Consumer Commission (ACCC) took legal action, and the Court imposed the following penalties:

- $700,000 fine against the company.

- $800,000 back-pay to the impacted workers.

- $325,000 against the managing director.

- 5-year ban from serving as company director.

It’s important to note that cleaning qualifications (if there is such a thing) would never have led to permanent residence. Permanent skilled visas are only available for highly skilled applicants. Also, the company had no cleaning jobs available for applicants with sponsoring employers in regional areas, as it had advertised.

Businesses found to be engaging in false or misleading or unconscionable conduct in the course of recruitment or sponsorship of foreign workers may be held liable under the Competition and Consumer Act.

Maximum penalties under Australian Consumer Law are:

- $1.1m for corporations per breach

- $220,000 for individuals

Practical guide to managing compliance: Compliance checklist

- Implement pre-employment screening

- Audit existing visa holders

- Keep records of visa type, conditions and expiry dates

- Keep copies of VEVO checks

- Schedule visa checks at visa expiry

- Monitor higher risk visas (e.g. bridging visas)

- Employment contracts – right to work, permission to check VEVO

- Contracts with recruiters and suppliers

Need help with managing your compliance?

The Migration Agency is, you will find, a little different. We can help with:

- Industry insights and legal briefings

- Strategic planning and advice

- Conducting immigration “health checks” or compliance risk assessments

- Drafting policies and procedures

- VEVO Work Entitlement Checks for visa holders of all subclasses

- Designing and implementing compliance programs

- Workplace investigations and DIBP monitoring.

- Bespoke immigration program design, implementation and management

And as part of our fixed fees, we provide a range of proactive and value-adding services. This includes notification of visa renewal dates, access to legal briefings, in-house training, webinars (internal and external), news bulletins, guides and tools to assist your members in managing the correct employment of overseas workers.

Get in touch with us today.